The Master Budget requires the approval of the Budget Committee earlier than it is put into operation. It might happen, sometimes, that a number of master budgets need to be ready before the final one is agreed upon. The finances usually incorporates particulars relating to sales , manufacturing costs, money place and key account balances (e.g. debtors, stock, fastened property, payments payable and so on.). It also exhibits the gross and the net profit, and the essential accounting ratios.

The price range usually incorporates details concerning gross sales, manufacturing costs, cash place and key account balances like fixed property, debtors, stock, and so on. This price range also shows necessary accounting ratios and gross and net revenue figures.

What’s An Operating Finances?

A private spending plan, just like a budget, helps outline where earnings is earned and expenses are incurred. Say you’re planning to replace your old refrigerator with a new mannequin that costs about $1,200.

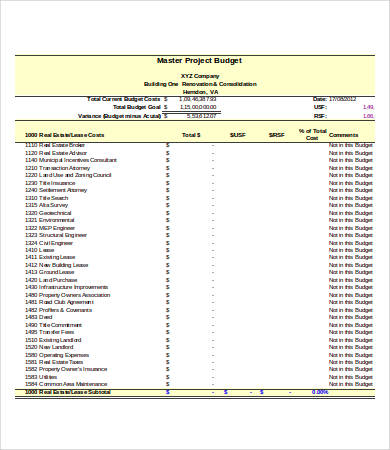

The accountability for the preparation of this budget rests with the executives of the gross sales departments. The budget for the complete administrative division might be ready by totalling the separate budgets of all administrative departments. The finances covers expenses of all administrative places of work, and of administration salaries. A careful evaluation of the wants of all administrative departments of the enterprise is very needed. The C.I.M.A. London has defined a Master Budget as – “the summary budget incorporating its practical budgets, which is finally approved, adopted and employed”.

Housing Expenses

There must be a co-ordination of selling bills with the quantity of gross sales expected and an effort should be made to control the costs of distribution. The preparation of the budget would depend on the analysis of the market situations by the administration, promoting insurance policies, analysis programmes and the fastened and variable components. Advertisement price range could occasionally be individually prepared to in case of huge enterprises. The finances contains all expenses referring to promoting, advertising, supply of goods to customers and so forth. It is healthier, if such costs are analysed in accordance with products, types of clients, territories, and the gross sales departments in the organisation itself.

By saving $200 a month in your sinking fund, you’d have the cash to purchase your new fridge in six months. If you can afford to save $300 a month, you’d have the money in four months. Instead of getting a mortgage and paying over time , begin putting money apart little by little until you’ll be able to pay for the price outright and don’t have to enter any debt. Consider how much wiggle room you could have in your major price range whereas planning out what initiatives must get carried out. If you have loads of disposable earnings and can easily put apart a couple of hundred dollars each month. But when you live paycheck-to-paycheck, give your self additional time to save. Start preparing for these expenses by making a listing of all your upcoming initiatives.

Creating The Finances Document

Think about every thing you plan to have accomplished inside a year’s time, but also contemplate work you intend to have done a few years out. The longer timeline you give yourself to avoid wasting up, the less money you’ll need to stash away each month. Planning prematurely for all your home improvement wants gives you time to avoid wasting up for the prices you’ll face. Here are five things to think about when creating a house enchancment price range.