What About Finances Forecasting And Planning?

One of the simplest ways to calculate your homebuying budget is the 28% rule, which dictates that your mortgage shouldn’t be more than 28% of your gross income every month. The Federal Housing Administration is a little more beneficiant, allowing customers to spend as a lot as 31% of their gross income on a mortgage. Homeownership includes quite a lot of ongoing prices, together with owners’ insurance, property taxes, and restore/upkeep bills.

The Way To Calculate Monthly Earnings

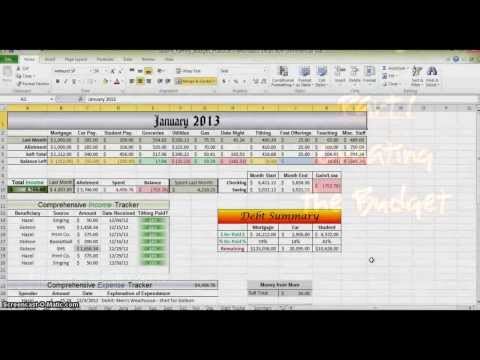

You also can set a reminder by clicking the Automation button above the toolbar. For extra data on establishing reminders, click here. Smartsheet is a spreadsheet-impressed work management device with sturdy collaboration and communication features. Its pre-constructed monthly budget template makes it even easier to create a budget, conduct month-to-month verify-ins, and enhance accountability. In this template, enter your monthly finances after which monitor it in opposition to your month-to-month actual spent.

With pre-set formulation in place, you will see your annual whole, annual finances, and annual variance mechanically calculated as you make changes to price range objects. Smartsheet’s highly effective collaboration options allow you to connect files, arrange reminders, and share your budget with key stakeholders. Income-Expense-Savings PieThis pie chart is useful to find out the breakdown of your finances, providing a visible of what proportion of your budget goes to earnings, financial savings, and expenses.

As the month progresses, input the actual greenback amounts for every of your budget objects under the present month column. You can arrange Reminders to happen on a every day, weekly or month-to-month foundation. To arrange Reminders, proper-click on on the respective row on the sheet and select Set Reminder.

Budget making turns into simpler in case of standard and recognized earnings as they’re simply estimated quantitatively. This contains the cash saved in post office, banks, insurance, premium, obligatory deposits and different schemes. When considering the affordability of a home, first-time buyers need to contemplate the situation and size of the property. After all, large isn’t all the time good, particularly if heating and cooling it breaks the budget. A quaint residence sitting atop a picturesque hill may be a dream come true, however shoveling that lengthy, steep driveway in the course of the winter months could possibly be a costly nightmare. So could that 3,000-sq.-foot fixer-upper, which seems super low-cost until you realize that you should renovate every room in the home.